Revolutionizing Personal Finance: Creating an AI-Powered Financial Agent

What if we could have a professional financial agent to help manage our money!

Timeline:

5 Weeks

Role:

Feature ideation, Product strategy, secondary research and Visual design

I sought to understand the ultimate component of stress that majority of individuals are going through: “Financial stress”. I took the opportunity to explore this space and explore product ideas

OPPORTUNITY

The lack of financial education is a significant challenge, but presents an opportunity to empower individuals by providing accessible and comprehensive financial education, enabling them to make informed decisions and achieve their financial goals.

CONTEXT

73% of Americans rank finances as the number one source of stress in life, CreditWise survey (White, 2021).

When looking to address the issue of financial stress, the simple answer of, “just save your money,” might arise. However, the problem of financial stress is a much deeper issue.

Not everyone can have a personal financial advisor to track costs and overhead

Many individuals have financial goals but no proper strategy to achieve them

Everyday money is spent, but the challenge is to learn one's own spending patterns

CHALLENGE

HOW MIGHT WE HELP YOUNGER ADULTS WHO EXPERIENCE FINANCIAL STRESS AT VARIOUS LEVELS BETTER MANAGE THEIR PERSONAL FINANCES

PROJECT METHODOLOGY

Literature Survey & Interviews

Data Synthesis

Ideation & Strategy

Final Design

SOLUTION

A PERSONAL FINANCIAL ASSISTANT BACKED BY AI

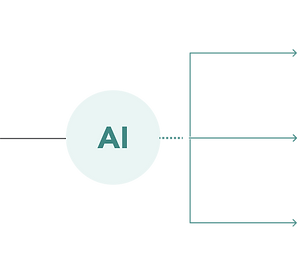

HOW AI CAN WORK

Personal spending data

Personalized goal setting

Personalized Notifications

Spending recommendations

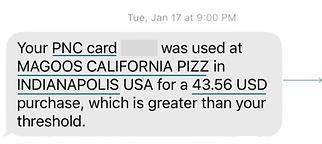

THE LOGIC

How AI can be used perform data sorting in the backend

-

Card details

-

Store name

-

Location details

-

Spend Amount

Sorts the spend category to “Food”

Compare spend amount to user set threshold

SORTING

Store location information

+

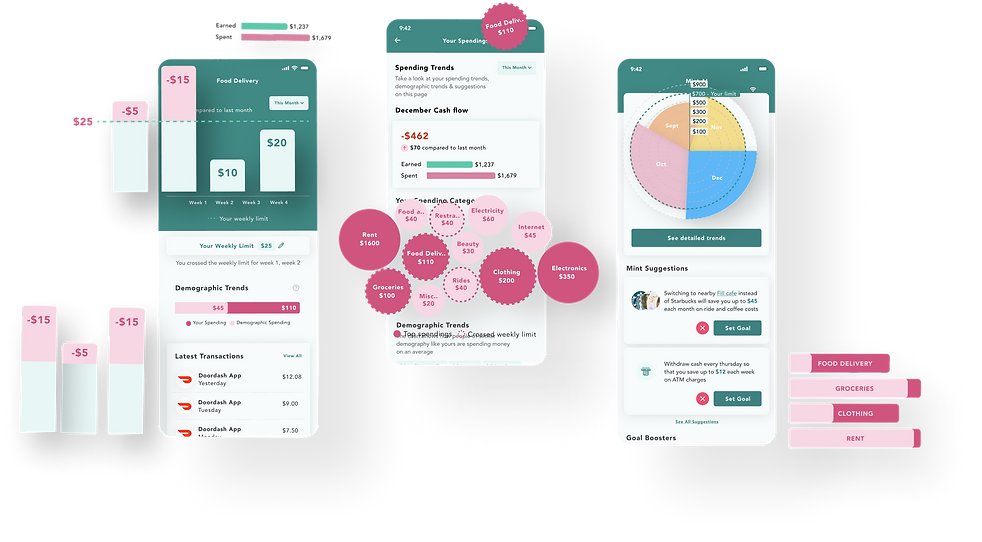

Our design

We have decided to add an AI section to the existing application to better its functionality. Mint is one of the most commonly used applications in our interview sample and is also one of the leading personal planner apps on the app store.

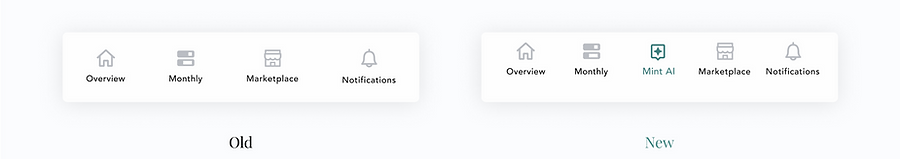

A NEW BOTTOM NAVIGATION

All new section

CHALLENGE 1

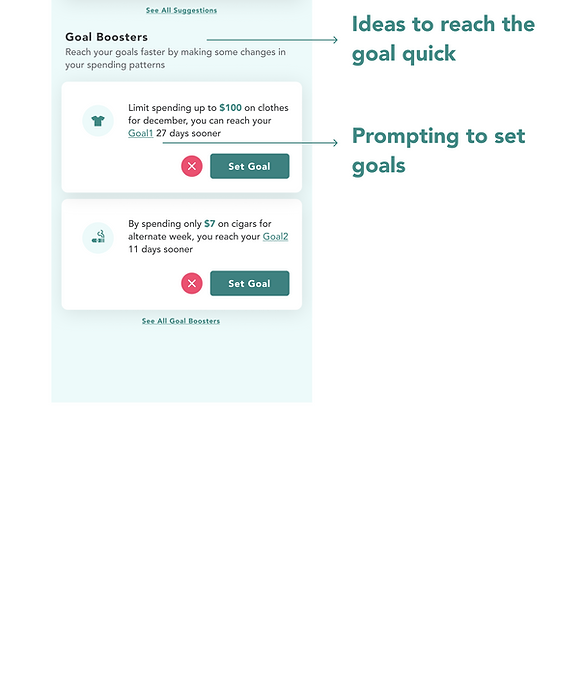

Motivating individuals to alter their spending habits and achieve financial goals requires a systematic approach that encourages informed decision-making

IDEATING 'MINT SUGGESTIONS'

Spending data

Data sorting

Personalized suggestions

CHALLENGE 2

The challenge of raising awareness about spending habits is reflected in the statement, "I don't know where all of my money is going!" This lack of understanding can make financial management and goal achievement difficult.

DETAILED SPENDING TRENDS

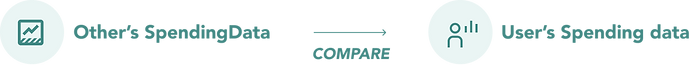

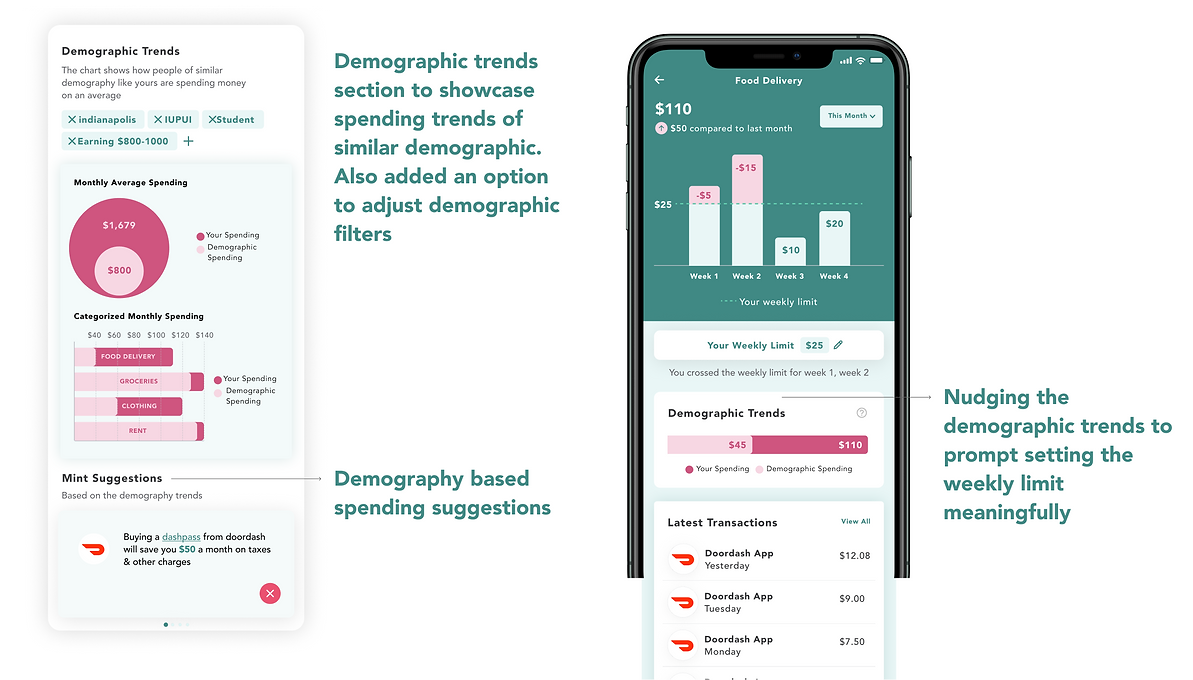

This screen has been ideated to view deeper details about the spending trends, the user gets to see the category-wise spending, and demographic trends.

CHALLENGE 3

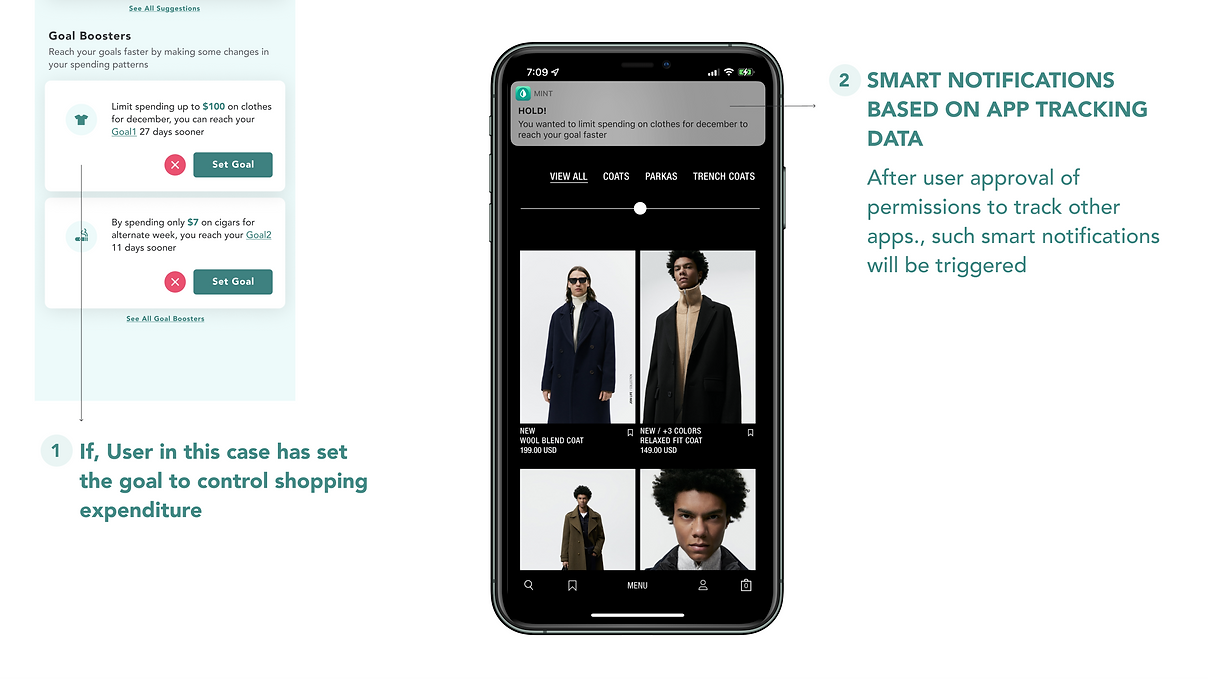

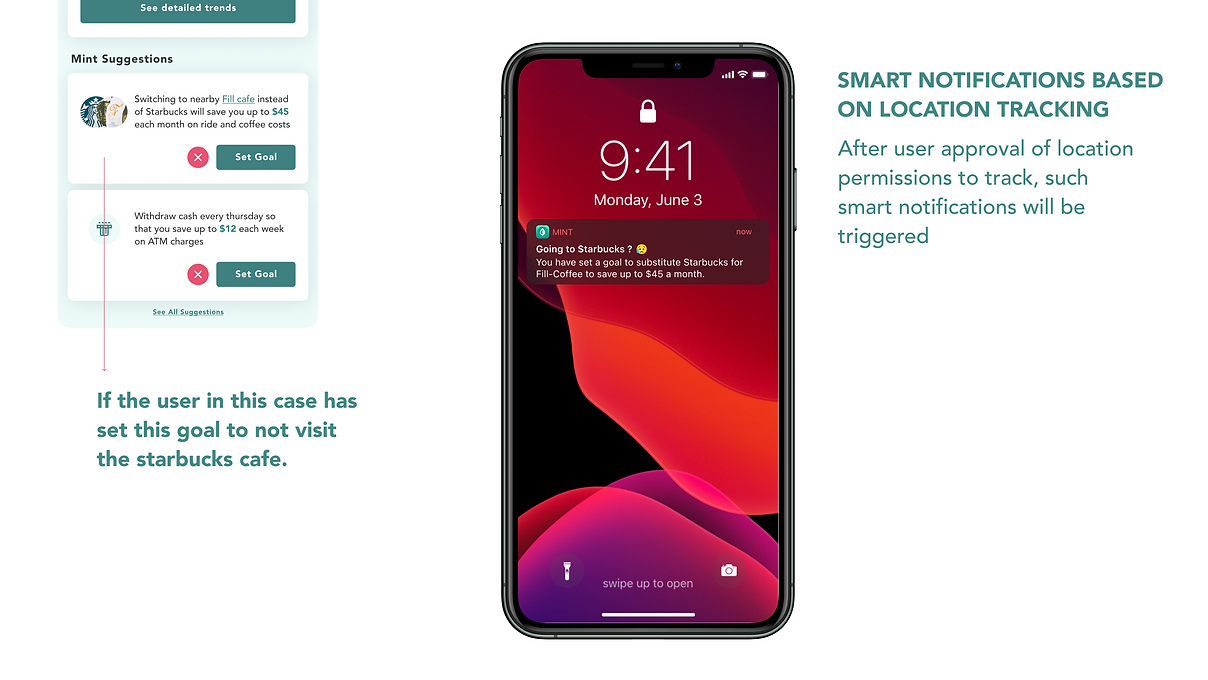

It can be challenging to maintain a clear path towards achieving goals. Finding effective ways to motivate individuals to stay on track towards their objectives is key.

IDEATING SMART NOTIFICATIONS

EXAMPLE 2

CHALLENGE 4

Random goal-setting can be demotivating, and proper guidance is necessary for individuals to set and achieve their objectives effectively.

IDEATING DEMOGRAPHIC TRENDS

LEARNINGS

Diving Deep into FinTech

Expanding My Knowledge and Gaining a Thorough Understanding of the Domain

Enhancing Collaboration

Working with a Research Team to Emphasize the Importance of Interdepartmental Cooperation

Diversity of Spending Habits

Understanding How People Manage Their Money Differently

Empathy Matters

Understanding the Vital Role of Empathy in Design and Life

Unlocking the Impact of AI and Design

Learn’t How this Dynamic Duo Can Revolutionize Our World

The Art of Design Thinking

Mastering the Process of Creative Problem-Solving in Design